does indiana have a inheritance tax

Indiana inheritance tax was eliminated as of January 1 2013. At this point there are only six states that impose state-level inheritance taxes.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Inheritance Tax should be paid to the county treasurers office which will issue a receipt of payment.

. Code 6-41-3 et seq. In general estates or beneficiaries of. In 2021 the credit will be 90 and the tax.

Even though Indiana does not collect an inheritance tax however you could end up paying inheritance tax to another state. Inheritance tax applies to assets after they are passed on to a persons heirs. Does Indiana have inheritance tax 2021.

Contact an Indianapolis Estate Planning Attorney. If you inherit from somone who lived in one of the few states. Twelve states and Washington DC.

There is also a tax called the inheritance tax. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Here in Indiana we did have an inheritance.

The Inheritance tax was repealed. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31.

Are required to file an inheritance tax return. On the federal level there is no inheritance tax. If inheritance tax is paid within three months of the.

Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. In general estates or beneficiaries of Indiana residents. Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

How Much Is Inheritance Tax. For individuals dying before January 1 2013. Whereas the estate of the deceased is liable for.

It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind. Indiana does not have an inheritance tax nor does it have a gift tax. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes.

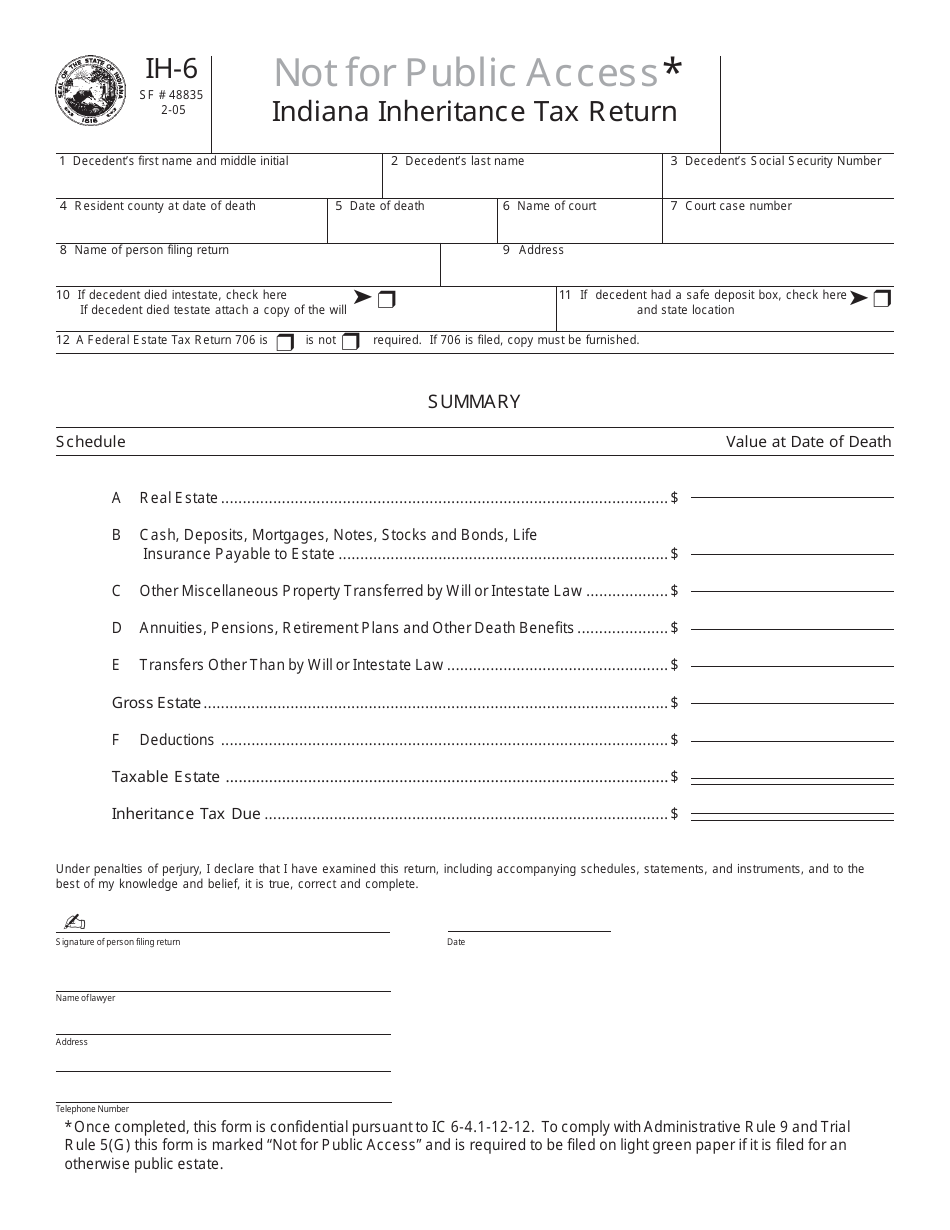

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Indiana repealed the inheritance tax in 2013. 31 2012 no inheritance tax has to be paid.

If payment is made within 9 months of the decedents death a 5. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Indianas inheritance tax still applies.

For individuals dying after Dec. Below we detail how the estate of Indiana. Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate.

As a result Indiana residents will not owe any Indiana state tax after this date. As of 1113 Indiana does not have inheritance tax Federal Tax Liens against Trust not Trustees Decedent and Estate Decedent and Estate Dower Rights Curtesy Rights Note 2. Indiana repealed the inheritance tax in 2013.

States have typically thought of these taxes as a way to increase their revenues. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. Even though Indiana does not collect an inheritance tax however you could end up paying inheritance tax to another state.

Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

Henry S Indiana Probate Law And Practice Lexisnexis Store

Indiana Estate Tax Everything You Need To Know Smartasset

Free North Carolina Last Will And Testament Templates Pdf Docx Formswift Will And Testament Last Will And Testament Personal Financial Statement

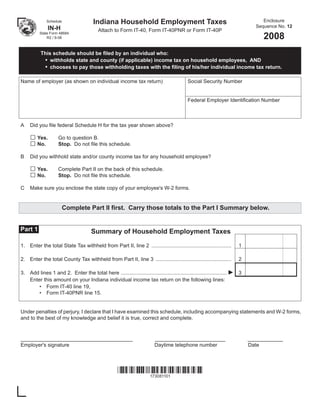

Indiana Household Employment Taxes

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Inheritance Laws What You Should Know Smartasset

Avoid These 15 States In Retirement If You Want To Keep Your Money Retirement New England States States

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

What Happens If You Die Without A Will In Indiana

What Should I Do With My Inheritance Inside Indiana Business

Everything To Know About Probate In Indiana In 2021 Webster Garino Llc

Historical Indiana Tax Policy Information Ballotpedia

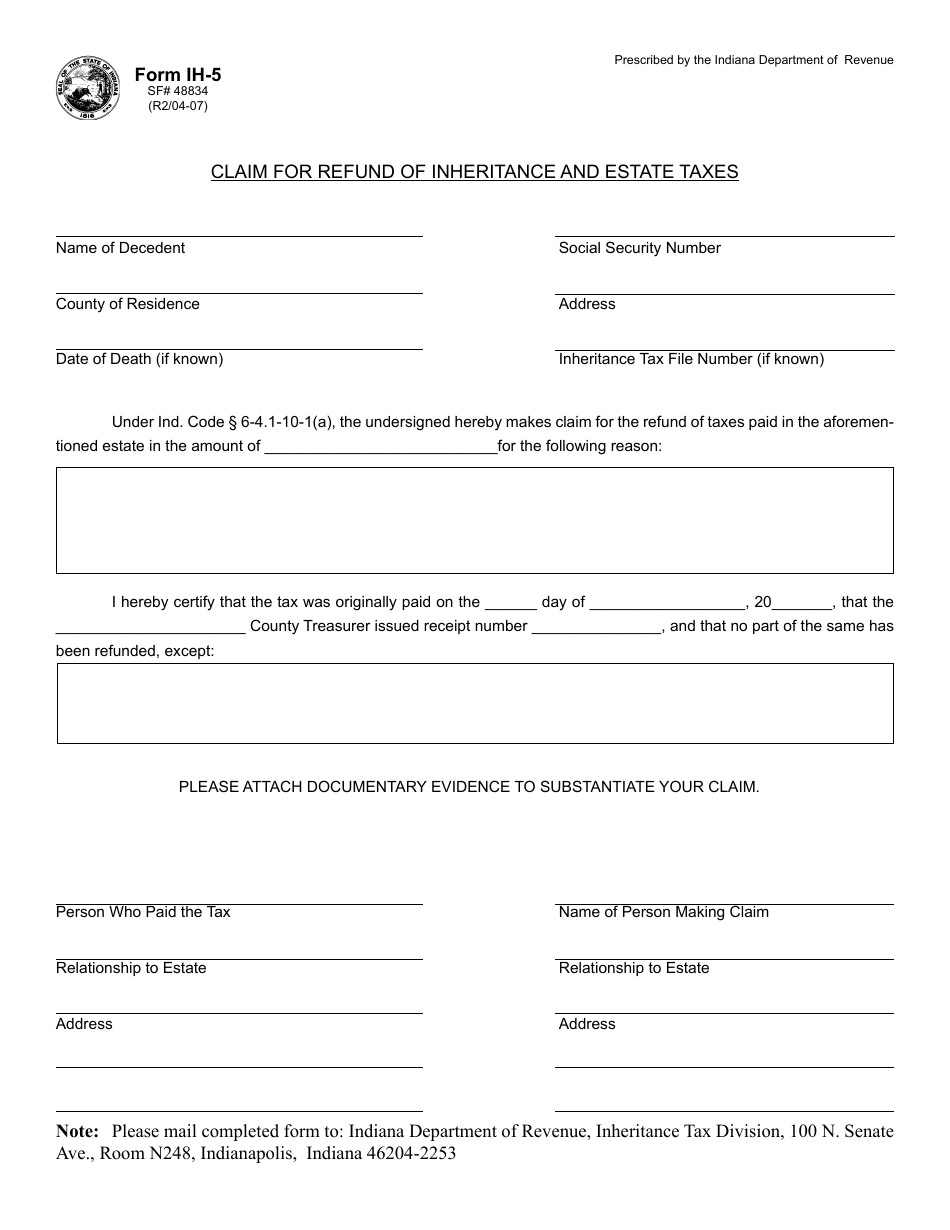

Form Ih 5 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller